Zimmer Biomet Adds TMINI Robotic System to Portfolio, Enhancing Orthopedic Surgery Innovation

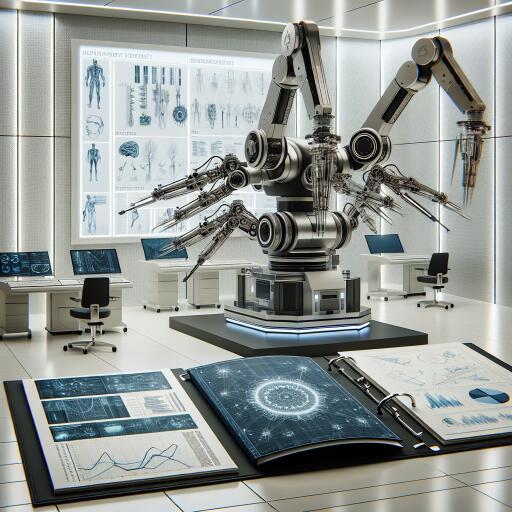

Zimmer Biomet Holdings, Inc., a pioneer in the realm of medical technology, has recently forged an exclusive distribution deal with THINK Surgical, Inc., marking a significant expansion of its robotics offerings with the inclusion of the TMINI Miniature Robotic System for total knee arthroplasty. This collaboration signifies a robust enhancement of Zimmer Biomet’s ROSA® Robotics suite, positioning the company at the forefront of surgical technology by providing surgeons with a handheld robotic option for knee surgeries.

The TMINI system stands out for its innovative approach to surgery, offering precise implant positioning based on preoperative CT scans. This addition aligns with Zimmer Biomet’s strategic expansion in robotic systems, following its earlier development of ROSA Shoulder, the first robotic system dedicated to shoulder replacement surgeries.

Dr. Nitin Goyal, Chief Science, Technology and Innovation Officer at Zimmer Biomet, emphasized the distinct advantage of their offering, stating, “We are proud to be the first medtech company to offer two complementary robotic systems for surgeons looking to incorporate robotic assistance while performing a knee replacement.”

Primed for an initial launch in select U.S. markets in the latter half of 2024, the TMINI system is poised to revolutionize ambulatory surgery centers and outpatient settings thanks to its ergonomic, wireless design. This move also showcases Zimmer Biomet’s continuous investment in technological advancements within the medical field, reinforcing its commitment to improving patient care through innovation.

With a rich history spanning over 90 years, Zimmer Biomet has established a global presence in more than 25 countries, delivering its products and advanced digital and robotic technologies to over 100 locations worldwide. This broad reach is complemented by its consistent focus on developing solutions that address the intricate needs of orthopedic surgery, thereby improving the outcomes and experiences of patients globally.

In light of this new partnership with THINK Surgical and the introduction of the TMINI robotic system, Zimmer Biomet also secured positive ratings from various investment firms, among them Piper Sandler and RBC Capital maintaining an Overweight and Outperform rating respectively, while both Citi and Goldman Sachs reiterated a Neutral stance.

These endorsements followed the company’s investor day revelations, where Zimmer Biomet unveiled its strategic long-range plan spanning 2024 to 2027. This long-term vision encompasses ambitions for mid-single-digit revenue growth, bolstered bottom-line growth, and strategic mergers and acquisitions. Furthermore, a collaboration with CBRE Group to establish orthopedic ambulatory surgery centers across the United States highlights Zimmer Biomet’s aspiration to enhance the accessibility of medical technology.

The company’s commitment to shareholder value is further demonstrated by a board-authorized stock repurchase program of up to $2 billion. This level of buyback activity signals a strong confidence in the company’s financial trajectory and intrinsic value.

From a financial health perspective, Zimmer Biomet exhibits commendable prowess with a robust gross profit margin of 71.88% in the last twelve months as of Q1 2024, indicative of efficient operations and a competitive edge in the medical technology landscape. Investment valuation metrics reveal Zimmer Biomet’s attractive P/E ratio of 24.3 and an adjusted P/E ratio of 19.36 for the same period, alongside a PEG ratio of 0.21, suggesting potential undervaluation relative to its growth projections.

Despite downward revisions in earnings expectations for the upcoming period, Zimmer Biomet’s market cap of 23.22 billion USD and a history of consistent dividend payments over 13 years underscore its standing as a leading entity in the industry, maintaining a dividend yield of 0.85% as per the latest records.

As Zimmer Biomet forges ahead with innovative partnerships and continues to invest in groundbreaking technological solutions, its strategic endeavors not only solidify its position in the medical technology sector but also present intriguing avenues for investors seeking robust and innovative healthcare investments.