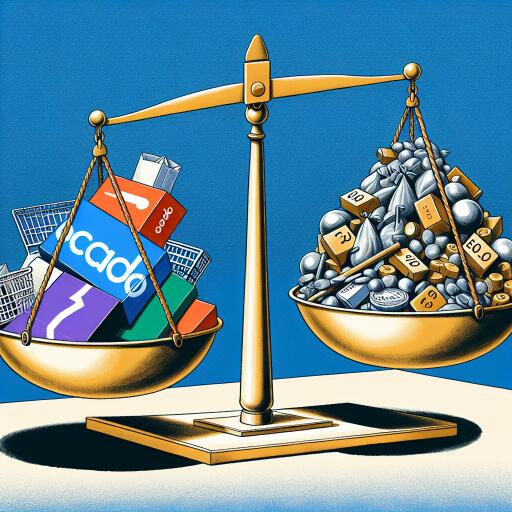

FTSE 100 Ends Down, Weighed by Ocado, Metals Prices

The FTSE 100 index concluded the trading session lower by 0.6%, finishing at 7,684.30 points, primarily affected by the online grocer and retail-technology specialist Ocado, along with a decline in commodity prices. The market encountered a sluggish start to the week in London amidst a calm day on the corporate news front, as observed by Chris Beauchamp, Chief Market Analyst at IG. Beauchamp elaborated that Ocado faces potential further declines as investors evaluate the repercussions of a disagreement with its crucial partner, Marks & Spencer. Additionally, a downturn to a four-month low for iron ore and a significant drop in copper prices suggest that more challenges lie ahead for the mining sector.

COMPANY NEWS Updates:

Next Eyes The Body Shop Assets Amidst Collapse: Reports from Sky News indicate that Next PLC is considering acquiring certain assets of the recently collapsed retailer, The Body Shop.

Hammerson’s Aberdeen Asset Sale: Hammerson has announced its intention to sell the Union Square Shopping Center in Aberdeen to an affiliate of Lone Star Real Estate Fund VI for 111 million pounds ($140.7 million).

Bunzl Experiences Turbulence:

Following guidance indicating a dip in both revenue and operating margin for the current year, triggered by a slower start in North America than anticipated, Bunzl’s shares have witnessed a significant fall. On a brighter note, Bunzl also confirmed the acquisition of an 80% stake in catering equipment distributor Nisbets for an initial cash transaction of 339 million pounds ($429.6 million).

Banking and Financial Sector Briefs:

The Bank of Ireland Group has projected a decrease in net interest income but anticipates a rise in business income for the current year. The bank has also outlined plans for capital returns equating to 13% of its market capitalization. Meanwhile, International Personal Finance has delayed its 2023 earnings release to assess the implications of a regulatory correspondence from the Polish financial watchdog.

Regulatory Probes and Strategic Talks:

The U.K. Competition and Markets Authority’s investigation into alleged information sharing among housebuilding firms regarding pricing and sales strategies has cast a shadow over the sector. Shares of significant housebuilders like Taylor Wimpey, Berkeley, Barratt Developments, and Persimmon have experienced downturns following the news. In other developments, Liberty Media Corporation is reportedly engaging in discussions with Bridgepoint for the potential acquisition of Dorna, the exclusive manager of the FIM Road Racing World Championship (MotoGP) through to 2041.

MARKET TALK and Strategic Insights:

With equity markets reaching potentially unstable highs, as illustrated by recent record-setting performances in Europe and the U.S., strategists from Saxo have voiced concerns. They suggest that it might be prudent for investors to reconsider their exposure to technology stocks or equities in general, advocating for increased diversification through bonds. Meanwhile, airline stocks have seen an uplift following comments from Ryanair’s CEO Michael O’Leary about an expected rise in peak summer fares for 2024, underscoring the continuous challenges faced by the sector including issues with Boeing and Airbus aircraft deliveries.

This collection of market movements and business strategies outlines a day of mixed fortunes and strategic shifts across diverse sectors, with implications for investors and companies alike.