Unilever Ice Cream Division Spin-Off: A Strategic Move Towards Growth

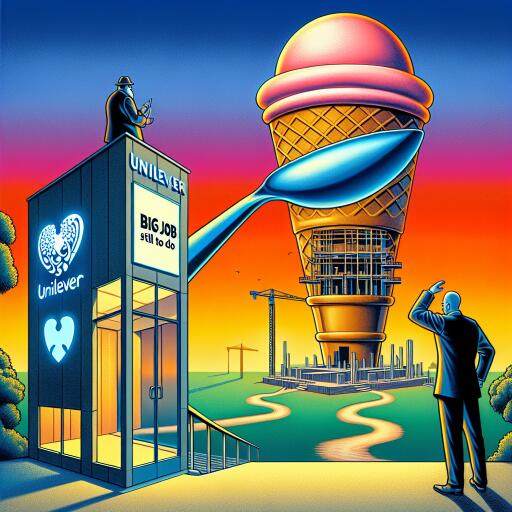

In a strategic pivot aimed at bolstering growth, Unilever PLC has announced plans to carve out its ice cream division, which includes beloved brands such as Ben & Jerry’s, Walls, and Magnum, into a separately listed entity. This move, according to Barclays analysts, is a positive step forward for the conglomerate, potentially sparking questions regarding the future of other segments within the company.

As a prominent player in the FTSE 100, Unilever’s decision to divest its ice cream business aligns with efforts to streamline operations and focus on core segments that promise higher growth rates. The transition comes amid growing pressure from investors and board members, including activist investor Nelson Peltz, to enhance profitability and market share. Peltz, who secured a board seat in 2022, has previously advocated for similar restructuring initiatives at rival firms such as P&G.

In conjunction with the divestiture announcement, Unilever has also revealed plans to initiate a comprehensive productivity program. This strategy includes a workforce reduction of 7,500 positions and aims to achieve approximately €800 million in cost savings over the coming three years, albeit at the expense of increased restructuring expenses.

Following the completion of the ice cream division sale, Unilever will reorganize its operations around four primary divisions: Personal Care, Beauty & Wellbeing, Nutrition, and Home Care. Analyst Warren Ackerman from Barclays suggests that this restructuring signifies Unilever’s intent to refocus its portfolio more towards the home and personal care sectors.

A notable point of discussion arising from this announcement is the potential reevaluation of Unilever’s Nutrition division, which, like the ice cream segment, has been considered dilutive to the company’s overall growth and profit margins. The separation of the ice cream business is expected to enhance Unilever’s medium-term growth outlook, with the company now targeting mid-single-digit growth post-separation, an improvement from the previously projected 3-5% growth rate.

According to Ackerman, the ice cream division has long been recognized as having limited synergies with Unilever’s broader portfolio. The decision to pursue a standalone entity reflects a proactive approach to addressing this disconnect and enhancing shareholder value. However, he also notes that the execution of this plan may extend until the end of 2025, indicating a period of strategic transition for Unilever.

The newly appointed head of the ice cream business, Peter Ter Kulve, is credited with a history of improving profitability within Unilever’s Homecare operations. His leadership is anticipated to drive significant enhancements in the cost structure and overall financial performance of the ice cream division.

Additionally, the spin-off is likely to positively impact Unilever’s ongoing gross margins. Historically, the ice cream segment’s gross margins have been approximately 10 percentage points lower than the company’s overall margin of 42% reported in 2023. The separation could therefore be a critical step towards achieving Unilever’s long-term gross margin goal, which is approaching 50%.

In summary, while Unilever’s decision to divest its ice cream business marks a significant strategic realignment, it represents a calculated effort to improve competitiveness and drive sustainable growth. As the company continues to navigate its restructuring process, the market’s response to these developments will be a key factor in determining Unilever’s future trajectory in the consumer goods industry.