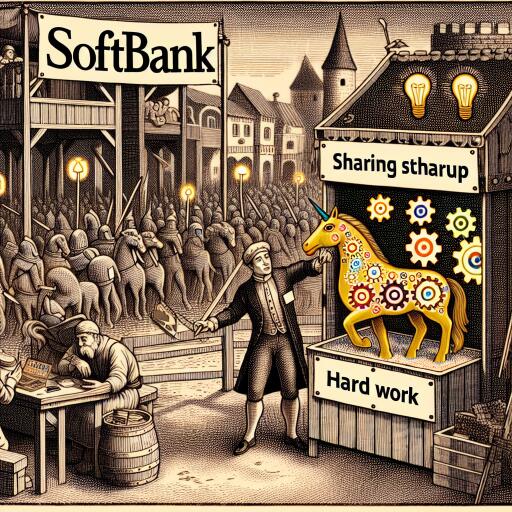

VOX POPULI: Softbank Bet on Wrong ‘Unicorn’ by Investing in Sharing Startup – Hard Work and Solitary Achievement

The late 1990s and early 2000s were enchanting times for the world of tech. The dot-com boom symbolized the zenith of the information technology (IT) era, with start-ups popping up at an unprecedented rate, all eager to cash in on the internet revolution. A joke from that era succinctly captured the essence of the time: “I started a company. What should I do to succeed?” The answer? “Easy. Just put ‘.com’ at the end of your company name.” Suddenly, any business, even those as mundane as cell phone sales, were at the cutting edge simply by virtue of existing in the IT space.

Fast forward to today, and “the sharing economy” has become the nouvelle vague of the business world, much like “IT” did back then. This model emphasizes the value of sharing over owning, a shift from the traditional business models that has seen a rapid emergence of companies based on this concept. Among the forefront of this movement is Airbnb Inc., an online marketplace that has reinvented how we think about arranging lodgings for travel.

Another notable player in this space has been WeWork Companies Inc., a firm providing shared office spaces globally. It pitched the concept that entrepreneurs co-sharing workspaces could benefit from networking opportunities. However, the expected market boom has not materialized to the extent anticipated, leading to significant headlines, especially in Japan, due to the involvement of Softbank Group Corp.

Softbank recently reported its first deficit in 15 years, a revelation that has resonated through the financial world. The company’s Chief Executive, Masayoshi Son, acknowledged misjudgment in overestimating WeWork’s success, admitting to a focus that was too heavily skewed towards the positives of the investment. Even for a seasoned businessman known for his golden touch in investment, this was a rare falter.

In the investment sphere, particularly in the United States, start-ups that achieve exceptional levels of success are often dubbed “unicorns.” WeWork was once categorized among these elusive companies. While Softbank is widely recognized for its mobile carrier business, it’s also known as a behemoth in the investment world. The adage “Even Homer sometimes nods” comes to mind, reflecting on whether this misstep was a mere oversight or indicative of a larger issue in Softbank’s investment strategies.

The concept of the sharing economy indeed represents a significant shift in how we approach ownership and communal resources. Companies like Airbnb and WeWork have undeniably been at the forefront of this shift, proposing new ways for individuals to interact with spaces and services. However, the story of WeWork and Softbank serves as a potent reminder that not every shiny venture leads to gold, and the path of innovation is fraught with risks.

As we navigate the evolving landscape of global business, remembering the value of solitary achievement and hard work remains crucial. While the allure of quick success in the tech world is undeniable, the traditional principles of business can’t be overlooked. The saga of Softbank’s investment in WeWork underscores the importance of balanced judgment and cautious optimism in the face of enticing but uncertain opportunities.

In this narrative, we witness not just a story of investment gone awry but a lesson on the complexities of modern business ventures. The tale of Softbank and WeWork is a contemporary fable, cautioning both investors and entrepreneurs to tread carefully in the labyrinth of the new economy. As we reflect on this episode, it’s essential to remember that in the world of business, as in life, not all that glitters is gold.