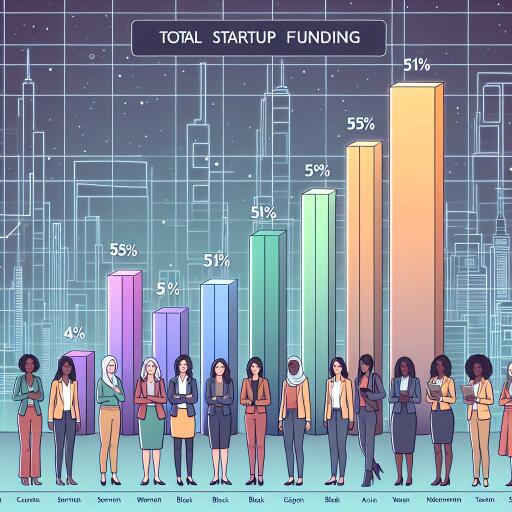

Women Led Startups’ Contribution To Total Startup Funding Plummets To 5% In 2023

The year 2023 has unfolded as a challenging period for startups worldwide, with India experiencing a significant downturn in venture capital funding, marking a seven-year low. Amidst this “funding winter,” women-led startups have faced disproportionately greater challenges in securing investment, highlighting persisting gender disparities in the entrepreneurial ecosystem.

Despite progress toward gender inclusivity in the business world, female founders continue to grapple with gender-based stereotypes and a shortage of female role models in leadership positions. This has resulted in a stark funding gap for startups led by women. According to recent data, U.S. startups that include at least one female founder received 26.1% of total venture capital in 2023, but all-women founding teams managed to secure a mere 1.8% of the investment pool. This trend is not confined to the United States; European Union female-led startups similarly struggled, raising barely 2% of total funding in 2021.

In India, the situation mirrors these global trends, with women-led startups raising over $480 million in 2023, marking an 80% decline from the previous year’s $2.4 billion-plus figure, as reported by Inc42’s Indian Tech Startup Funding 2023 Report. Remarkably, women-led entities, encompassing co-led firms, all-women teams, and female solopreneurs, contributed to only 5% of the total $10 billion raised by Indian startups in 2023.

Among the sectors, ecommerce, enterprise tech, and edtech saw the most activity from women-led startups, with enterprise tech startups attracting the highest amount of funding. Despite these examples of success, the broader picture remains bleak, with early-stage women-led startups receiving the least amount of funding, signaling deep-seated gender bias and stereotypes that question women’s leadership competences and risk appetite.

While seasoned entrepreneurs and investors argue that gender bias diminishes in the growth stage of startups, the crux of the issue appears to lie at the early funding stages, where personal biases and societal stereotypes are more likely to influence investors’ decisions. This has sparked a conversation about the need for gender-neutral approaches and gender-lens investing from the outset.

The conversation extends beyond the startup and investment communities to policymakers and governmental agencies. In India, efforts are being undertaken to support women entrepreneurs, including dedicating a portion of the government-backed Fund of Funds for Startups Scheme to women-led ventures and launching platforms aimed at supporting women in entrepreneurship.

Despite these initiatives, the challenge of closing the gender funding gap remains formidable. Venture capital funds, investors, and supportive communities are called upon to drive change by fostering an environment where women entrepreneurs can thrive equally.

As we look towards the future, the hope is for a shift towards more equitable funding practices that recognize the value and potential of women-led startups. With concerted efforts from all stakeholders, the aim is to not only bridge the gender funding gap but to create an ecosystem where diverse and inclusive entrepreneurship can flourish, unlocking new opportunities for innovation and growth.