JOLTS Data Reveals Imbalance in U.S Labor Market: Implications for the Federal Reserve

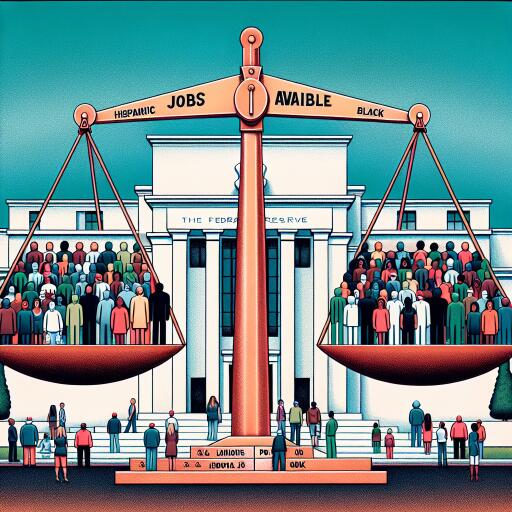

The U.S. Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) is a crucial indicator for the Federal Reserve, especially for Chair Jerome Powell, offering insights into the labor market’s health. This survey highlights the relationship between job vacancies and job seekers, a key measure of labor market balance or imbalance.

After a period of decline, the ratio of job openings to job seekers has recently surged to over 1.4-to-1, significantly higher than the pre-pandemic ratio of 1.2-to-1. While job openings increase, the quits rate, indicating employees’ confidence in securing new jobs, has returned to pre-pandemic levels, impacting wage growth expectations.

This shift has implications for the Federal Reserve’s monetary policy decisions. With the job openings to job seekers ratio rising, there’s a looming concern over potential decreases in job numbers and increases in unemployment rates. The trends in non-farm payroll growth further intensify these concerns, pointing towards possible structural challenges in the labor market and complexities in achieving a soft landing for the economy.

The JOLTS data thus remains essential for the Federal Reserve in its efforts to navigate the U.S. monetary policy amidst these labor market dynamics.