Bonds of Bank Hit by Historic Brazil Floods Lure Investors Back – BNN Bloomberg

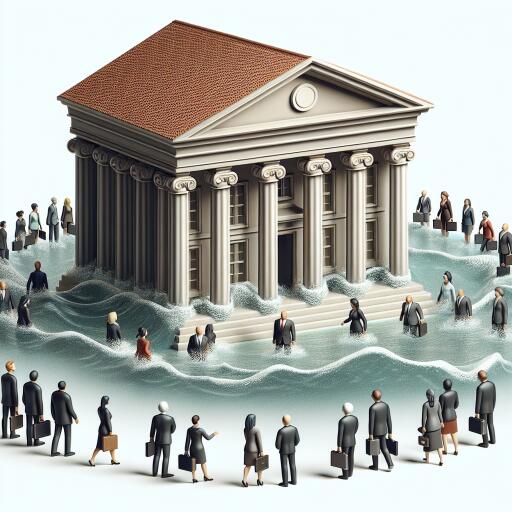

In the wake of devastating floods that hit Rio Grande do Sul, Brazil’s southern state, two of the country’s largest money managers, JGP Asset Management and Ibiuna Investimentos, have significantly increased their stakes in the affected regional bank, Banco do Estado do Rio Grande do Sul SA (Banrisul). The investors’ move is a gamble on the bank’s resilience and its capacity to weather the catastrophic impact of the natural disaster.

The flooding event, which saw torrential rains submerge approximately four-fifth of Rio Grande do Sul – home to 11 million people and representing about 53% of Banrisul’s risk exposure – has wrought considerable damage. Infrastructure, including roads and energy distribution, was majorly impacted, stirring Fitch Ratings to place Banrisul on negative watch. Despite these alarming developments, both JGP and Ibiuna are betting on the bank’s robust financial health.

“Banrisul is one of the few Latin American credits that offer good risk-adjusted returns,” explained Eduardo Alhadeff, managing partner at Ibiuna, in an interview. Alhadeff highlights the bank’s “robust” balance sheet as a pivotal factor that should help absorb the anticipated surge in bad loans due to the floods.

Following the natural disaster, the bond prices suffered a sharp decline, only to largely rebound to pre-catastrophe levels in the following month. Dollar notes due in 2031 were last seen trading at 94 cents on the dollar.

Both investment firms adjusted their positions in the aftermath of the floods. Ibiuna, which initially held local tier 2 subordinated financial notes of Banrisul, sold this debt post-floods and instead opted to invest in the bank’s dollar bonds. Similarly, JGP, despite having a “small exposure” to the bank’s financial notes prior to the floods, retained these bonds and increased their holdings when prices fell.

Alexandre Muller, a credit portfolio manager at JGP, noted, “It’s been hard to find pockets of value in Latin America,” marking Banrisul and Peruvian zinc miner Volcan as the only new offshore bond positions his firm took this year. According to Muller, such market dislocations present arbitrage opportunities for keen-eyed investors.

The crisis in Rio Grande do Sul disrupted various industries, from banking to auto manufacturing and insurance, stretching all the way to the vital agricultural sector. Banrisul’s significant presence in the region makes it notably vulnerable; its exposure is much higher compared to competitors such as Banco do Brasil SA and Itau Unibanco Holding SA.

In response to the flooding, Banrisul announced a suite of measures in May aimed at supporting affected businesses and individuals. This includes a substantial credit line designed to assist with companies’ working capital needs and terms for renegotiating existing debt for those in the hardest-hit municipalities.

The federal government has also stepped in, offering a 15 billion reais emergency credit line through the national development bank BNDES to support businesses within the state.

Yet, the long-term effects of this disaster on Banrisul’s financial health remain uncertain. Jean Lopes, an analyst at Fitch Ratings, echoed this sentiment, stating the limited visibility on the catastrophe’s longer-term fallout. “We will only be able to see the full impact in three or four months,” said Lopes, referencing the delay before the full extent of the catastrophe’s impact becomes clear.

Before increasing their investment in Banrisul’s bonds, Ibiuna conducted several stress tests on the bank, even simulating scenarios thrice as severe as the impact seen during the Covid-19 pandemic. Alhadeff is confident that, even in their worst-case projections, the bank’s balance sheet remains resilient enough to cover potential defaults, concluding, “Yes, defaults should increase, but there is room to absorb that.”

This calculated optimism by some of Brazil’s largest money managers regarding Banrisul’s resilience in the face of unprecedented natural disaster sheds light on the complex interplay between environmental events, regional banking stability, and investor sentiment in emerging markets. As the situation unfolds, the market’s reaction to Banrisul’s handling of this crisis will be closely watched by investors and analysts alike.