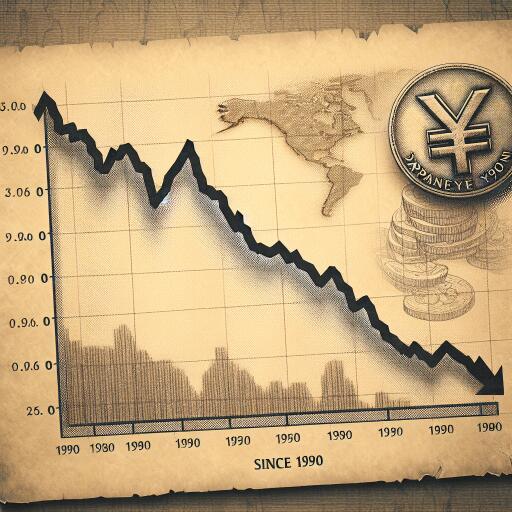

Japanese Yen Reaches Its Lowest Value Since 1990

In a significant financial shift, the Japanese yen (JPY) has dropped to unprecedented levels against the US dollar, marking its weakest performance since the year 1990. As recent as the latest market analysis, the exchange rate plummeted, with 100 yen trading for just 5.07 HKD, descending beneath the critical 5.1 threshold for the first time since June 1990. This decline comes in the wake of the US dollar’s surge, attributed to unexpectedly strong retail sales data in March, which led to a 0.6% increase in the USD/JPY rate.

This financial landscape presents a golden opportunity for those looking to purchase Japanese goods or plan a trip to Japan. With the yen’s value at a low, international spending power in Japan has increased, making it an excellent time for shopping sprees or tourism. In fact, Japan has seen a surge in tourist arrivals, setting a new record last month by welcoming over 3 million visitors, eclipsing the previous high of 2.99 million in July 2019. This influx is largely driven by the advantageous exchange rate, with many foreign visitors looking to maximize their purchasing power.

Apart from consumer goods and travel, the depreciating yen is also enticing investors to the Japanese real estate market, eyeing potential gains from property investments while the currency remains weak.

Yet, interested individuals and investors should heed warning signs and consider acting swiftly. Japan’s Finance Minister, Shunichi Suzuki, has expressed concerns over the yen’s sharp decline, stating that the government is vigilantly observing the situation and “will take all necessary steps” to stabilize the currency. The government has a history of intervening in the currency market to shore up the yen, as seen in 2022. With the yen’s current valuation already crossing the threshold that previously triggered government action, another intervention could be on the horizon, although it remains to be seen when and how this might occur.

The present scenario beckons consumers and investors alike to capitalize on the favorable conditions. Whether it’s acquiring coveted items from Studio Ghibli or embarking on an unexpected journey to Japan, the opportunity is ripe. Given the unpredictable nature of currency markets, it might be a long wait before such an opportune moment arises again. Seize the day and make the most of the current yen depreciation. Who knows when the next chance will come, potentially not for another few decades.